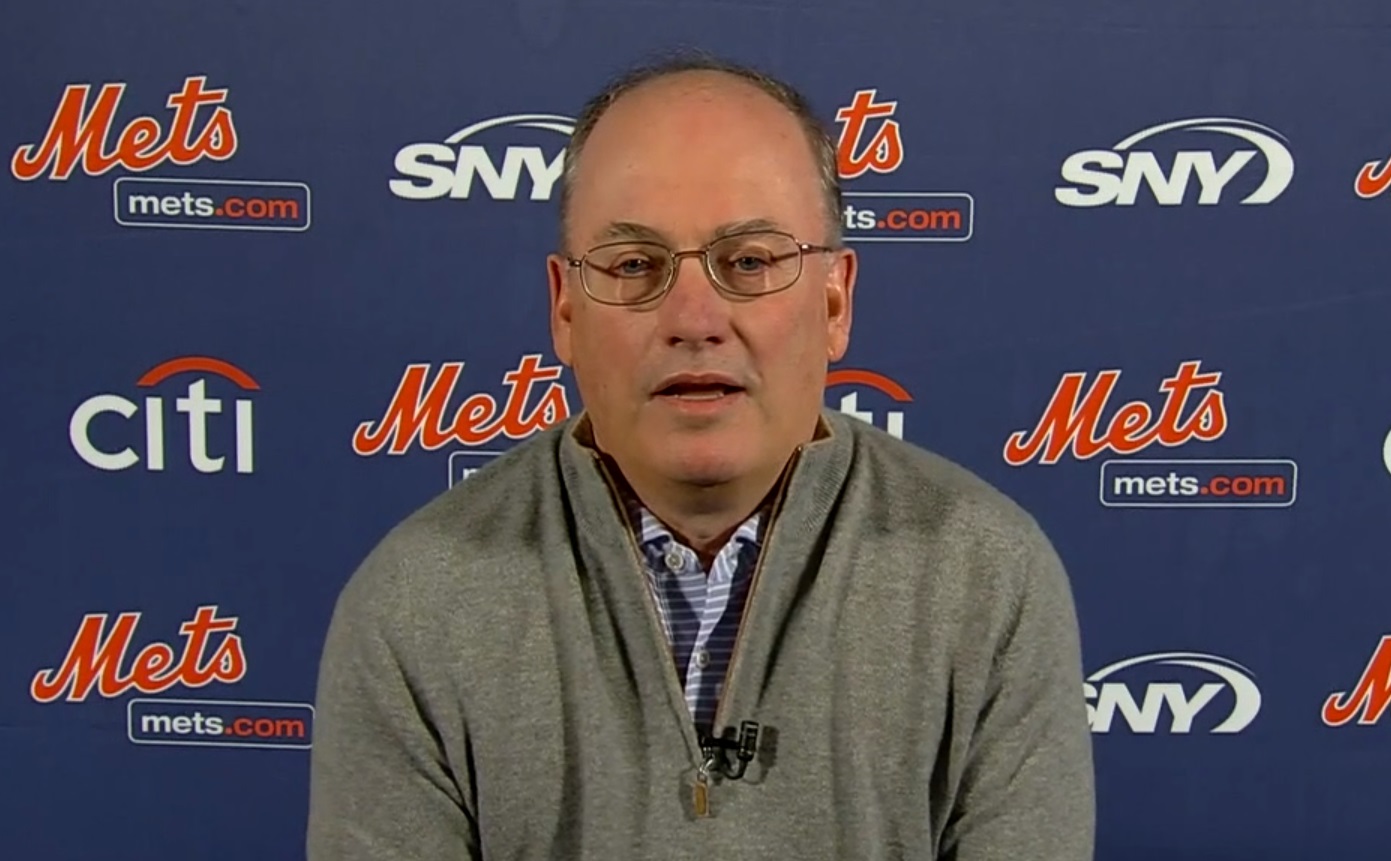

Steve Cohen has once again found his name involved in a Wall Street scandal, and the New York Mets owner is defending himself against criticism from retail investors.

Cohen’s investment group, Point72 Asset Management, is one of two firms that pumped a combined $2.7 billion into a hedge fund called Melvin Capital Management this week. The fund, which is run by Cohen’s former associate Gabe Plotkin, lost an enormous sum of money after a group of retail investors banded together on Reddit and other social media forums to buy stock in GameStop. Melvin Capital had a massive short position against GameStop, meaning they were betting on the price of the stock going down. By purchasing stock in GameStop, millions of inexperienced investors sent the price of the stock skyrocketing, forcing short investors to scramble to cover their positions and cut their losses.

Things came to a boil on Thursday when Robinhood and other investment platforms restricted trades of GameStop stock and other stocks that had become Reddit favorites. There are theories floating around that Cohen’s investment group and others like his are behind the restrictions as a means of protecting their short positions and preventing mammoth losses.

Barstool Sports founder Dave Portnoy called Cohen out over that, and the Mets owner responded. The two went back and forth on Twitter.

“You bailed out Melvin cause he’s you’re boy along with Citadel. I think you had strong hand in todays criminal events to save hedge funds at the cost of ordinary people. Do you unequivocally deny that?” Portnoy asked Cohen.

Portnoy pointed out that Robinhood says they are trying to protect their users by restricting certain trades, but everything they were doing favored the hedge funds that were losing billions. Cohen agreed that those moves should be investigated.

Good question. Those questions should be directed at Robin Hood etc. I’m a trader just like your like you are . When you find out give me a holler

— Steven Cohen (@StevenACohen2) January 28, 2021

Legitimate questions that deserve answers . My guess is they were protecting their own hide if stocks burst and people couldn’t put up margin . It happens in commodity markets all the time . They don’t have to lend money if they don’t want to

— Steven Cohen (@StevenACohen2) January 28, 2021

Of course, Cohen has to understand why investing in the hedge fund that got burned by Reddit would raise questions. Cohen used to run a hedge fund called SAC Capital. The fund was shut down following allegations of insider trading. Cohen was never charged, but the firm pleaded guilty to trafficking in nonpublic information and was forced to return investor capital and pay $1.8 billion in fines. Cohen was banned from managing other people’s money for two years beginning in 2016.

There were some questions about whether Major League Baseball would approve Cohen’s bid to buy the Mets last year because of the insider trading scandal. He was ultimately given the green light.

The Wall Street drama has become the talk of the internet this week. Ole Miss even got in on it and tried to turn it into a marketing tool.